USDA loan refinance: Customizable Solutions for Reducing Your Loan Term.

USDA loan refinance: Customizable Solutions for Reducing Your Loan Term.

Blog Article

Optimize Your Financial Freedom: Advantages of Funding Refinance Explained

Car loan refinancing offers a calculated chance for individuals looking for to improve their monetary freedom. By securing a lower interest price or readjusting car loan terms, borrowers can effectively decrease monthly repayments and enhance money flow.

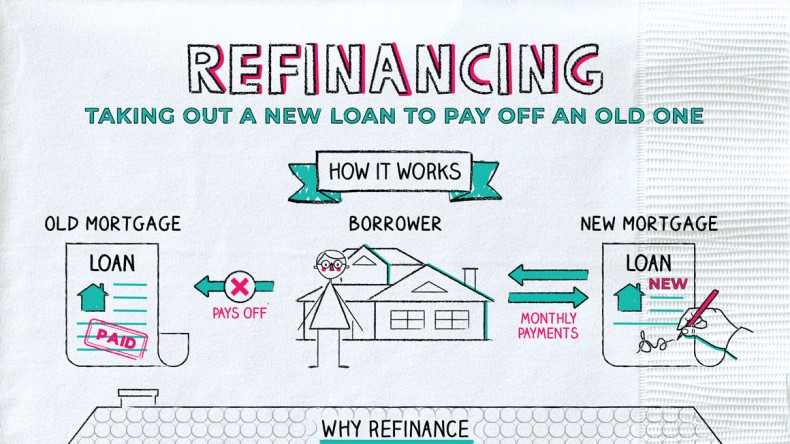

Recognizing Financing Refinancing

Understanding funding refinancing is vital for property owners seeking to maximize their monetary circumstance. Loan refinancing includes replacing a present home mortgage with a new one, commonly to accomplish far better finance terms or conditions. This monetary approach can be used for different factors, including adjusting the financing's duration, modifying the sort of rate of interest, or settling debt.

The key objective of refinancing is usually to minimize month-to-month repayments, consequently boosting capital. Home owners might likewise refinance to access home equity, which can be utilized for substantial expenses such as home renovations or education. Furthermore, refinancing can offer the opportunity to switch over from an adjustable-rate home loan (ARM) to a fixed-rate home mortgage, offering even more security in monthly repayments.

Nonetheless, it is critical for home owners to assess their economic scenarios and the associated prices of refinancing, such as shutting costs and fees. A comprehensive evaluation can help identify whether refinancing is a prudent decision, stabilizing possible savings versus the first expenditures included. Inevitably, recognizing lending refinancing encourages property owners to make informed choices, boosting their economic well-being and leading the way for long-term security.

Decreasing Your Rates Of Interest

Numerous home owners seek to decrease their rates of interest as a main motivation for re-financing their home mortgages. Reducing the interest rate can dramatically reduce regular monthly settlements and overall loaning costs, permitting individuals to assign funds in the direction of various other economic objectives. When passion rates decline, re-financing offers an opportunity to safeguard a more favorable lending term, inevitably improving economic security.

Refinancing can lead to significant savings over the life of the funding (USDA loan refinance). As an example, decreasing a rates of interest from 4% to 3% on a $300,000 home mortgage can result in countless dollars conserved in passion payments over three decades. Furthermore, reduced prices might allow property owners to settle their finances quicker, hence increasing equity and reducing financial debt much faster

It is necessary for property owners to examine their current home mortgage terms and market conditions prior to deciding to re-finance. Assessing possible cost savings against refinancing prices, such as closing fees, is essential for making a notified decision. By taking advantage of lower interest prices, home owners can not only enhance their monetary freedom however likewise produce a much more secure financial future on their own and their households.

Combining Financial Debt Effectively

Home owners often find themselves handling several financial obligations, such as credit score cards, personal loans, and various other financial responsibilities, which can result in enhanced tension and difficult monthly settlements (USDA loan refinance). Consolidating financial obligation effectively via financing refinancing supplies a streamlined service to take care of these financial burdens

By re-financing existing lendings right into a single, a lot more workable financing, property owners can streamline their payment procedure. This method not only decreases the variety of monthly settlements yet can additionally decrease the overall passion price, depending upon market conditions and specific credit score profiles. By combining financial obligation, house owners can assign their resources extra efficiently, liberating money circulation for necessary expenses or cost savings.

Adjusting Finance Terms

Readjusting loan terms can significantly impact a house owner's financial landscape, specifically after settling current financial obligations. When you could try here re-financing a home loan, borrowers can customize the length of the finance, rate of interest, and settlement routines, straightening them much more carefully with their existing financial circumstance and objectives.

As an example, expanding the car loan term can decrease month-to-month payments, making it simpler to handle capital. This may result in paying even more you can try these out interest over the life of the finance. Alternatively, choosing a shorter lending term can cause higher regular monthly payments yet significantly lower the total passion paid, enabling customers to build equity quicker.

In addition, readjusting the rates of interest can influence general affordability. Homeowners may switch over from a variable-rate mortgage (ARM) to a fixed-rate home loan for security, securing in reduced prices, particularly in a desirable market. Alternatively, refinancing to an ARM can supply lower initial payments, which visit this website can be beneficial for those expecting an increase in earnings or monetary situations.

Improving Capital

Re-financing a mortgage can be a calculated method to boosting cash money flow, permitting consumers to designate their financial sources better. By safeguarding a reduced rate of interest price or prolonging the loan term, home owners can considerably reduce their regular monthly mortgage repayments. This prompt decrease in expenditures can liberate funds for various other important needs, such as paying off high-interest debt, conserving for emergencies, or buying chances that can yield higher returns.

Furthermore, refinancing can provide consumers with the choice to convert from a variable-rate mortgage (ARM) to a fixed-rate home mortgage. This transition can support monthly settlements, making budgeting less complicated and enhancing economic predictability.

Another avenue for boosting capital is through cash-out refinancing, where property owners can borrow against their equity to access liquid funds. These funds can be made use of for home renovations, which may boost home value and, ultimately, cash circulation when the home is sold.

Conclusion

In verdict, car loan refinancing provides a critical possibility to enhance financial liberty. By lowering rate of interest, settling financial debt, adjusting loan terms, and boosting cash flow, individuals can accomplish a more positive monetary setting. This method not just streamlines repayment processes but also advertises effective resource allocation, ultimately cultivating long-term financial security and flexibility. Welcoming the advantages of refinancing can lead to considerable renovations in general monetary health and wellness and security.

Report this page